rhode island income tax rate

Income Tax is hereby amended to read as follows. In Rhode Island the more you make the more youre taxed.

Rhode Island Income Tax Calculator Smartasset

The current tax forms and tables should be consulted for the current rate.

. Subscribe for tax news. Below we have highlighted a number of tax rates ranks and measures detailing Rhode Islands income tax business tax sales tax and property tax systems. 2022 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island government. Rhode Island Division of Taxation. Directions Google Maps.

For income taxes in all fifty states see the income tax by state. Discover Helpful Information and Resources on Taxes From AARP. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599.

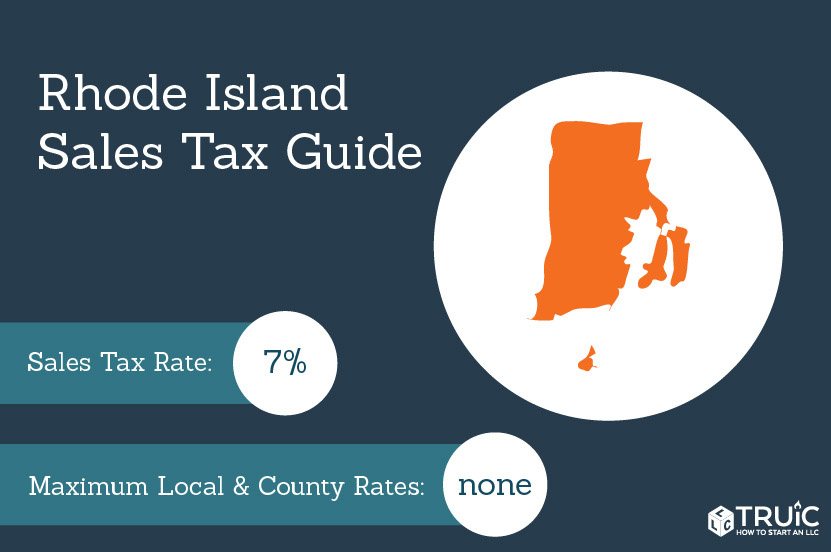

1 RI Earned Income Credit - RIGL 44-30-26c2N 2 Property Tax Relief Credit - RIGL 44-33 3 RI Residential Lead Abatement Credit - RIGL 44-303 4 Credit for Taxes Paid to Other States - RIGL 44-30-18 5 Historic Structures Tax Credit - RIGL 44-332. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. 34 cents per gallon of regular gasoline and diesel.

RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. Income tax tables and other tax information is sourced from the Rhode Island Division of Taxation. Only the following credits are allowed against Rhode Island personal income tax.

For those employers at the highest tax rate the UI taxable wage base will be set 1500 higher at 26100. The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty four states with higher marginal corporate income tax rates then Rhode Island. The Division of Taxation has posted the income tax rate schedule for 20 22 that will be used by fiduciaries for many trusts and estates.

The first step towards understanding Rhode Islands tax code is knowing the basics. Rhode Island Division of Taxation - Page 3 of 5. Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

The range where your annual income falls is the rate at which you can expect your income to be taxed. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600.

Uniform rate schedule The Division of Taxation has recalculated tax bracket ranges for tax year 2021 as required by statute. For more information about the income tax in these states visit the Massachusetts and Rhode Island income tax pages. Rhode Island taxable income -- Rate of tax.

Each tax bracket corresponds to an income range. Terms used in the Rhode Island personal income tax laws have the same meaning as when used in a comparable context in the federal income tax laws unless a different meaning is clearly. Income tax rate schedule.

For an in-depth comparison try using our federal and state income tax calculator. Find your income exemptions. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Find your pretax deductions including 401K flexible account contributions. Find your gross income. One Capitol Hill Providence RI 02908.

2020 Rhode Island tax brackets and rates for all four RI filing statuses are shown in the table below. For more information about the income tax in these states visit the Rhode Island and Florida income tax pages. Rhode Islands maximum marginal income tax rate is the 1st highest in the United States ranking directly below Rhode Islands.

1 et seq not including the increase in the basic standard-6. Your 2021 Tax Bracket to See Whats Been Adjusted. DO NOT use to figure your Rhode Island tax.

Guide to tax break on pension401kannuity income. 4 a Rhode Island taxable income means federal taxable income as determined under the. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator.

We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. How does Rhode Island rank. 10 -Rhode Island Corporate Income Tax Brackets.

Check the 2022 Rhode Island state tax rate and the rules to calculate state income tax. Unlike the Federal Income Tax Rhode Islands state income tax does not provide couples filing jointly with expanded income tax brackets. Rhode Island has a flat corporate income tax rate of 7000 of gross income.

For income taxes in all fifty states see the income tax by state. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. For an in-depth comparison try using our federal and state income tax calculator.

To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. How to Calculate 2022 Rhode Island State Income Tax by Using State Income Tax Table. The changes were made to the Rhode Island personal income taxs uniform tax rate schedule which is used by all filers.

Rhode Islands 2022 income tax ranges from 375 to 599. Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599. The income tax is progressive tax.

Internal Revenue Code 26 USC. The Rhode Island tax is based on federal adjusted gross income subject to modification. 153 average effective rate.

The UI taxable wage base is set at 465 percent of the average annual wage of workers at taxable employers. As a convenience tables for tax year 2021 and tax year 2022 appear below. Ad Compare Your 2022 Tax Bracket vs.

Click the tabs below to explore.

Rhode Island Sales Tax Small Business Guide Truic

Check Out How Many Rhode Islands See How Many Rhode Islands It Takes To Fill Any Country Pretty Fun Website Http H Rhode Island Island New England States

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Usa State Sales Tax Rates 2018 Centers For Disease Control And Prevention Family Income Usa States